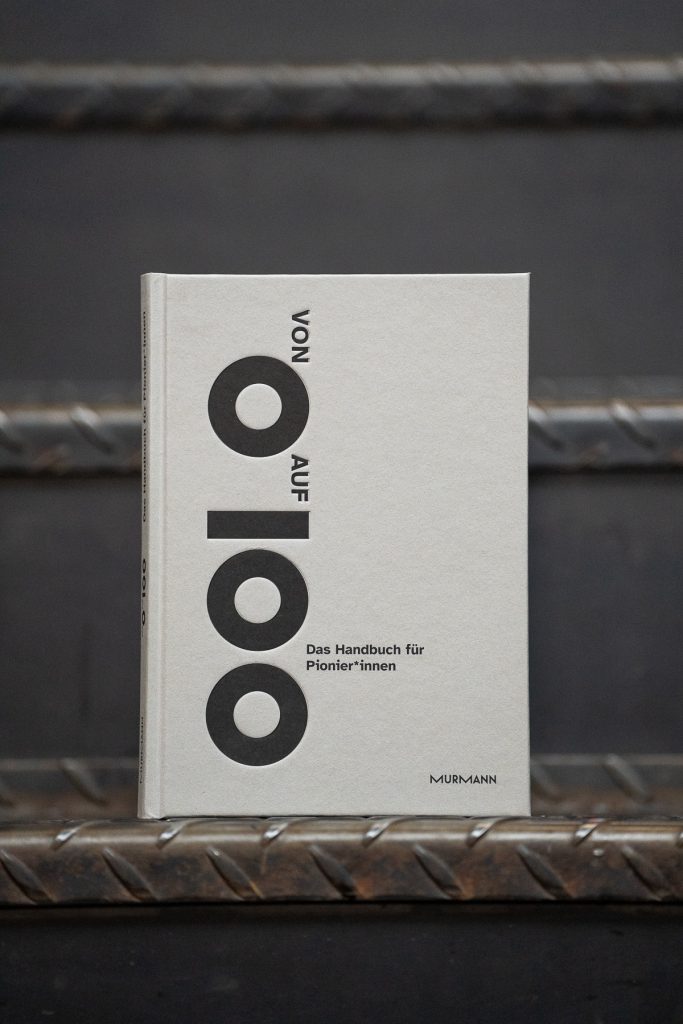

“From 0 to 100” is not only available online, but also on paper. The essential handbook supports people who want to make a difference with their ideas. It provides motivation to actually put ideas into action.

Simple initial calculation: do your sums add up?

Example VillageOffice

A project has to pay off sooner or later. What did VillageOffice?s first rough estimate look like?

From the outset, the team focussed on a very specific offer under the title "co-working experience". The plan was as follows:

• VillageOffice finds 20 companies that each send 10 employees to a co-working space on a trial basis.

• The VillageOffice team supports the company during the implementation of this trial. The team members have their expenses reimbursed but do not receive a wage.

• In return for the additional customers, the co-working spaces receive a flat fee amounting to around one-third of the going rate, thus helping to keep costs down.

• The University of St. Gallen supports this experiment with a study, thus creating a basis for acquiring further companies for the project at a later date. The university charges a greatly reduced pro bono rate for the study.

• Each company pays a flat fee for their participation.

This calculation resulted in a small profit for VillageOffice, which was to be invested in the development of the co-working space network, thus allowing for a gradual increase in the capacities made available for the programme over time.

My 0 to 100 moment:

The celebration upon generating your first revenues. Or a simple initial calculation that sees you balance your books.

Be aware that your project is certain to generate costs. This may include rental fees, material procurement costs and communication expenses. In an initial rough estimate, you compare your costs and potential revenue. This will help you to remain flexible in all situations.

Every cost counts Make a differentiation between fixed and flexible costs. Don?t leave any out. Your salary, for example. Even if you don?t plan on paying yourselves anything at the outset, this is sure to change at some point.

Change the parameters and check whether your coffers are still full. What would happen if only 10 percent of the target group were to accept your offer rather than 50 percent?

Thinking in terms of scenarios Imagine different scenarios: the best possible scenario, the worst case scenario and something in between. This will ensure you are prepared for a great deal.

Willingness to pay For your service to have a value, it must offer a specific benefit for your target group. Find out what people are willing to pay for it.

Think in stages Think about your project in stages and for each step set quantitative goals that you want to achieve. You can then use these as a basis to measure your success, i.e. the impact of your project, and make changes where necessary.

this provides you with an initial overview of your project finances.